Almost everything you own and use for personal and investment purposes is considered a capital asset. Examples include a home, personal use items such as household furnishings, and stocks and bonds held as investments. For the purposes of this article, we will focus on stocks that are held for investment and the tax implications of selling them.

There are many ways to acquire an asset, such as inheritance or gift. We will consider a transaction that begins by simply buying shares of stocks.

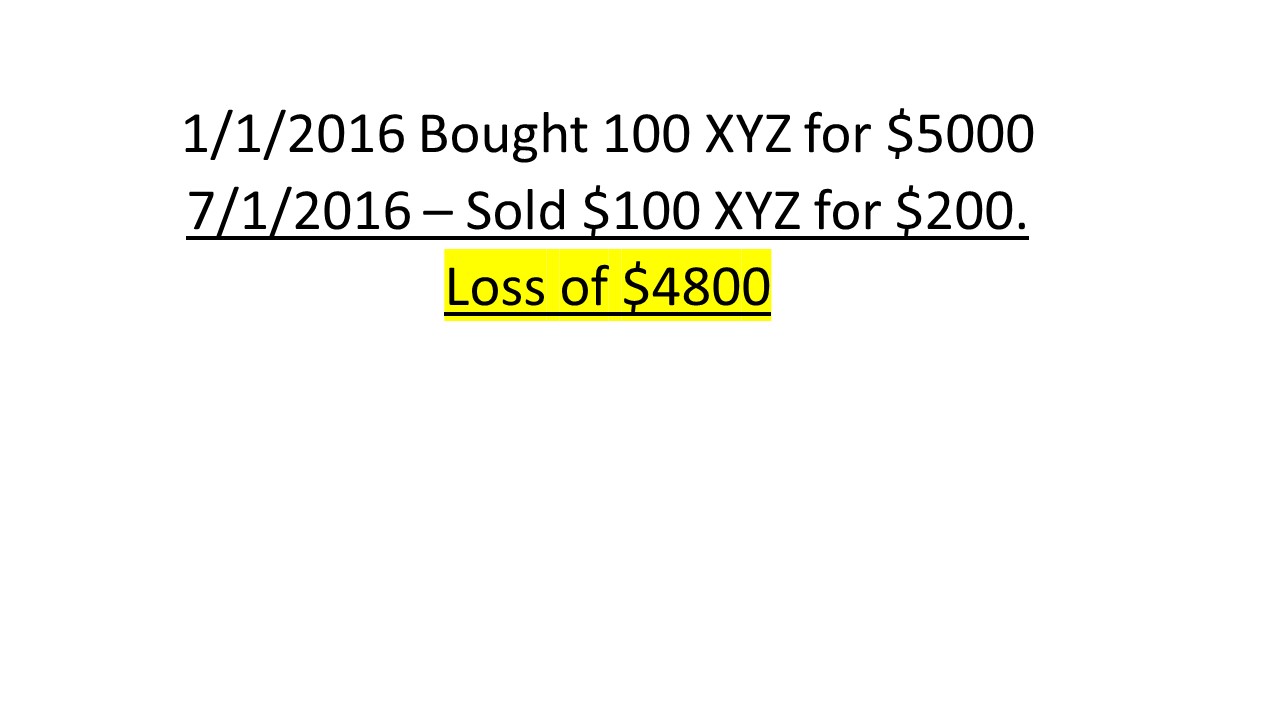

Let’s assume that you purchase one hundred shares of XYZ stock for fifty dollars per share. If you paid a commission, that would be included as part of the cost basis for tax purposes. For now, we will assume that you had a free trade so your costs basis is $5,000. (100 shares X $50/share).

Six months later, the stock is worth $200. You’ve pretty much lost all your money. You decide to cut bait and sell the stock. The total amount that you get for the stock is $200, which equates to a loss of $4,800. That’s a lot of dough, Joe! Your broker, sensing your plight, decides not to charge a commission.

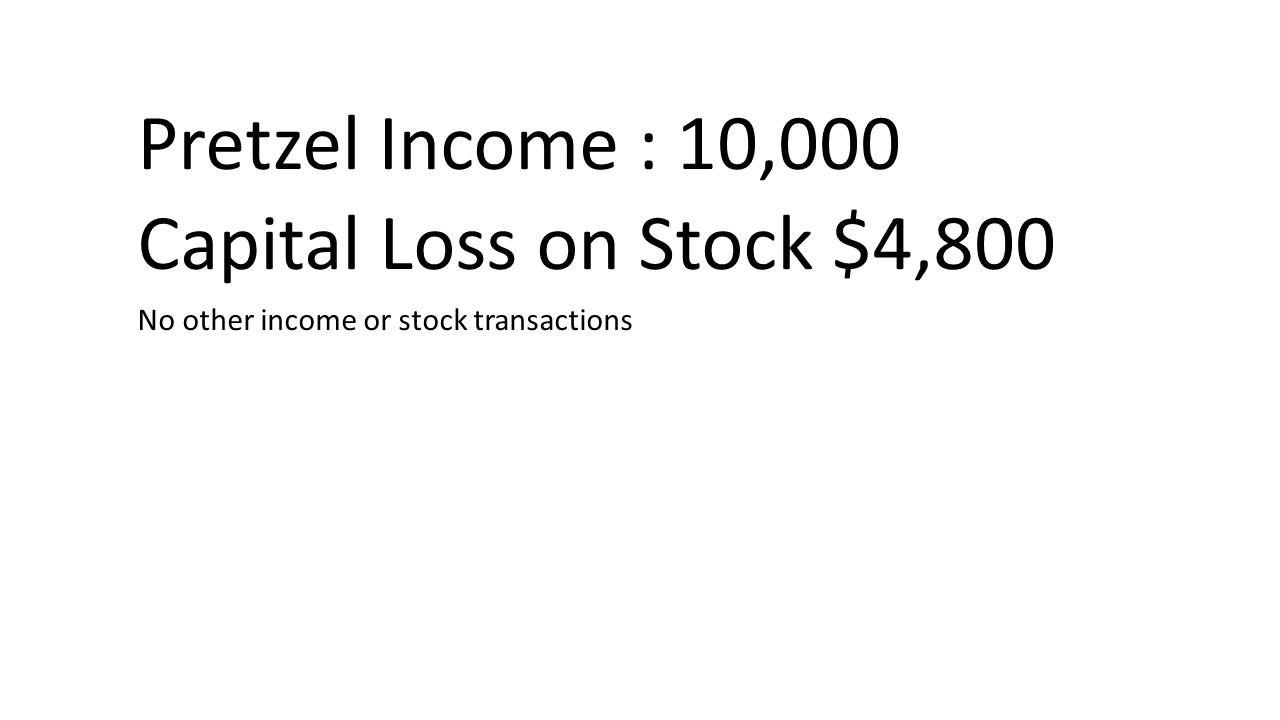

Well, you blew all your cash so you have to now get a job to pay the bills. You score a nice gig selling pretzels outside the train station. You also manage a sweet profit margin as each pretzel you sell only costs fifteen cents but you sell it for twenty five cents! Ka-ching!!

As I mentioned in a prior post, location is everything when you are peddling food. You have the best location in town with serious pedestrian traffic and move enough pretzels to garner a $10,000 profit for yourself.

You visit your local tax preparer and report the following:

If you had other stock transaction that you made money on, you could use the loss from XYZ to offset the gains. Regrettably, we have $4,800 in losses and no stock gains to offset. That’s the bad news. The good news is that you can use up to $3,000 of those losses to offset ordinary income (pretzel income), per year, until the loss is exhausted. The loss can be carried forward indefinitely.

The three thousand of losses goes to offset three thousand of this years income and the other $1800 is carried forward to future years. You are also permitted to carry back losses to prior years in certain circumstances, but that’s for another blog post.

To encapsulate, you can use your investment losses to offset your investment gains. If you have no investment gains, then you can use $3,000 per year, indefinitely (until the loss is all used up), to offset ordinary income.

DISCLOSURE: THIS ARTICLE IS NOT INTENDED TO BE INVESTMENT OR TAX ADVICE ADVICE AND SHOULD NOT BE RELIED UPON AS SUCH. PLEASE CONSULT A QUALIFIED ADVISOR TO DETERMINE THE MOST APPROPRIATE INVESTMENTS AND TAX STRATEGIES FOR YOUR PERSONAL SITUATION.