RESOURCE: NRMLA CONSUMER GUIDE

I’ve seen this same commercial many, many times for reverse mortgages and it features none other than Arthur Fonzarelli aka The Fonz!!!!!

If the Fonz says it’s good then it must be, ay? As I recall, though, I seem to remember that the Fonz lived on top of the Cunningham garage and had to rely on Mrs. C for his coffee in the morning. With that in mind, I figured I should look further into it myself.

Home equity is one of the most important assets for many people. I think it is the last asset to be utilized in the event of a retirement income shortfall. For some, it is the only asset they have. My parents, and many people of their generation were such people. Regardless of how bad things could get, they always had a place to hang their hat.

I tell people that, if they plan for the future and don’t do anything crazy, they wont have to worry about eating cat food when they are 80. That always seems to resonate.

I’ve always encouraged a very conservative approach to home equity, for that reason. The one warning sign of the financial crisis of 2008-2009 related to mortgages that I will never forget was when I saw a commercial for a debit card that allowed to take cash out of an ATM. That is insane.

When you have a mortgage on your home, you make monthly payments to the lender. When you have a reverse mortgage, you get a loan in which the lender pays you. Reverse mortgages take part of the equity in your home and convert it into payments to you. The returns are usually tax free. Generally, you don’t have to pay back the money for as long as you live in your home. When you die or move out, the loan has to be repaid.

Types of Reverse Mortgages

There are three types of reverse mortgage:

Single purpose reverse mortgage: aka “Property Tax Deferral Programs” . As the name implies, this is a reverse mortgage that can only be used for one specific purpose. The lender determines the purpose that the money can be used for, such as home repairs or property taxes.. You can’t just take your monthly payment and get a bus to the Casino! These types of reverse mortgages make up a small amount of the overall market.

Proprietary Reverse Mortgage: these are reverse mortgages that are offered by a private company. The terms of the loan are set by the lender as they are not federally insured.

Home Equity Conversion Mortgages (HECM) these are federally insured mortgages that are backed by the U.S. Department of Housing and Urban Development (HUD). HECM loans can be used for any purpose. These types of mortgages can be more expensive than traditional homes and can have high upfront costs. Before applying for a HECM, you must meet with a counselor from an independent government-approved housing counseling agency. Some lenders offering proprietary reverse mortgages also require counseling.

We will focus on the Home Equity Conversion Mortgages (HECM)

Lets look at some considerations:

How old do I have to be?

To be eligible for a FHA HECM, the FHA requires that you be a homeowner 62 years of age or older, own your home outright, or have a low mortgage balance that can be paid off at closing with proceeds from the reverse loan, have the financial resources to pay ongoing property charges including taxes and insurance, and you must live in the home.

How much can I borrow?

The amount varies by borrower and depends on:

1.) Age of the youngest borrower or the youngest non borrowing spouse.

2.) Current interest rate

3.) Lesser of appraised value or HECM FHA mortgage limit of $625,500 or the sales price

How do I get the money?

There are a variety of options for receiving the proceeds such as lump sum, line of credit and monthly payments.

What are the costs to me?

First, with a reverse mortgage, you are required to pay real estate taxes, utilities, and hazard and flood insurance premiums.

You have to shop around on the costs because they can vary from lender to lender.

The three largest closing costs are the Federal Housing Administration (FHA) mortgage insurance, the origination fee, title and other closing settlement fees. However, the only cost that is typically paid out-of-pocket is for counseling.

There is an initial mortgage insurance premium amount and an annual insurance premium.

The origination fee is what the reverse mortgage lender earns on the loan. HUD uses a formula to determine this amount, which has a maximum of $6,000.

You are also responsible for the closing and settlements fees, appraisal fee and other closing costs.

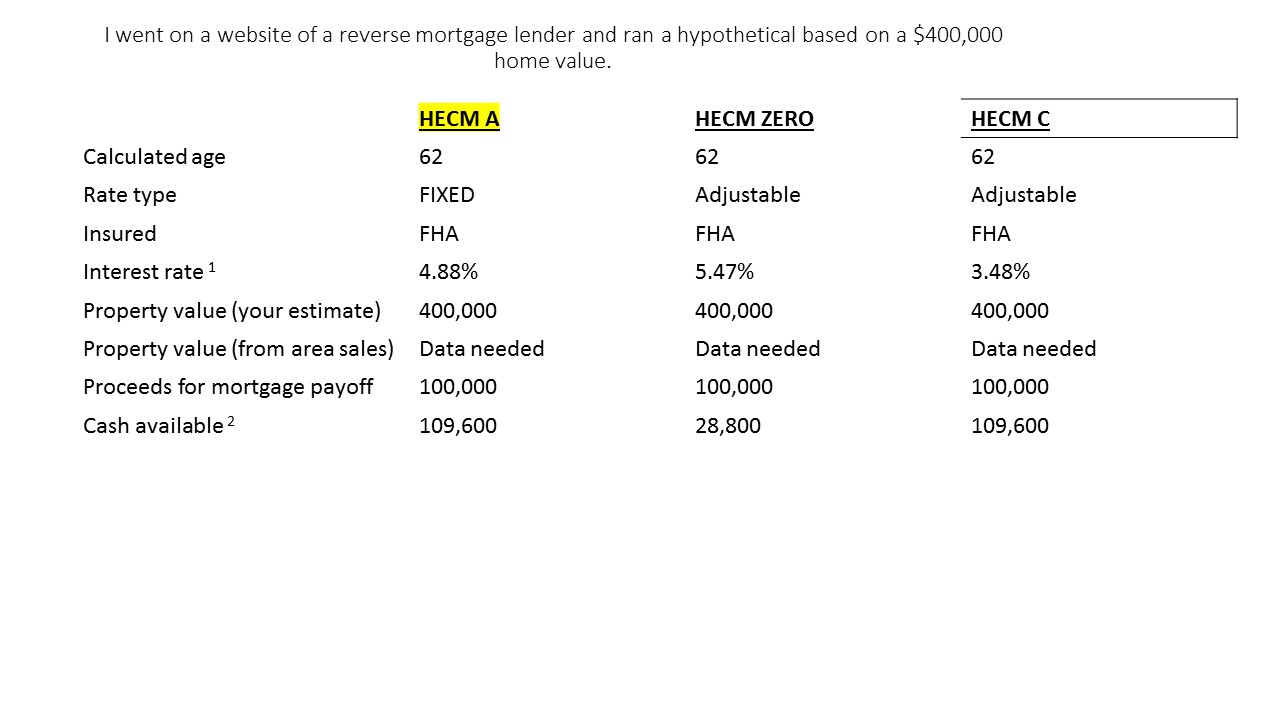

It appears as though there are some other decisions to make here with regard to the different types of HECM products. The HECM ZERO product doesn’t seem to be much help but, hey, if it’s a last resort.

When does it have to be paid back?

The loan becomes due when all homeowners have passed away and/or moved out of the house permanently.

What happened to my mortgage payment?

There are no more monthly mortgage payments because the mortgage was paid off at closing on the reverse mortgage.

Does my estate inherit the home?

It does but there will be a lien on the title that needs to be paid off. If your heirs wish to keep the house in the family, hopefully they can come up with the cash to pay off the reverse mortgage loan.

THE MARKET MAKER’S WIT (WHAT I THINK)

My opinion is that this should be an absolute last resort. You literally should be on your way to the store to buy cat food before you take out one of these reverse mortgages. Before considering these, you need to consult a financial planner and estate attorney, at least. One of the selling points on these are that you can get one with little to no upfront costs. The reason for this is that most of the costs can be financed into the mortgage. No thanks!

Sources:

National Reverse Mortgage Lenders Association

DISCLOSURE: A REVERSE MORTGAGE IS A BANK PRODUCT AND MAY NOT BE SUITABLE FOR YOU. THIS ARTICLE IS NOT ATTENDED TO BE FINANCIAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. CONSULT YOUR OWN FINANCIAL PLANNER AND ESTATE ATTORNEY BEFORE CONSIDERING A REVERSE MORTGAGE.